The Hidden Chaos of Estate Settlement: Why Families Get Blindsided by Bureaucratic Nightmares

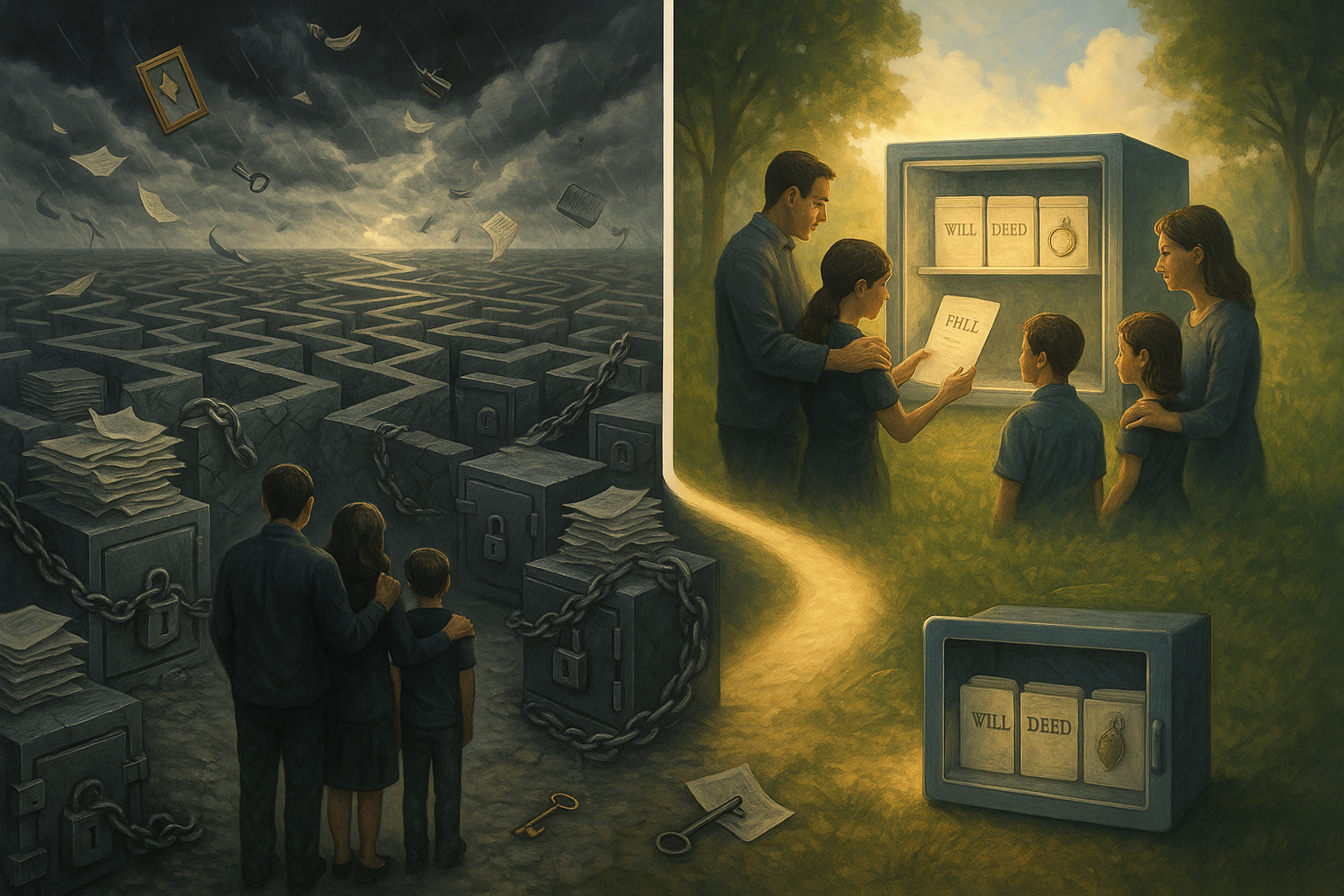

Estate settlement often feels less like closure and more like chaos—a hidden information crisis that blindsides grieving families. Most Americans dramatically underestimate the time, cost, and complexity required to manage a deceased relative's “stuff.” The moment someone passes, survivors are catapulted into a bureaucratic maze that demands knowledge they almost never possess. According to recent studies, like the 2024 Probate Study from Trust & Will, families are left scrambling without a roadmap.

Picture this: You're already knee-deep in grief, and now you're playing detective, lawyer, and accountant all at once. It's not just sad—it's a total shitshow waiting to happen if you're not prepared. At StashDog, we get it: domestic chaos is our enemy, and estate settlement is one of its ugliest forms. Let's break down why this happens and how you can dodge the bullet.

The Nightmare Begins: Why Estate Settlement Is So Damn Hard

Let's face it—67% of Americans leave no will or estate plan at all. That means loved ones must confront probate, the court-run legal process for sorting out assets, debts, and legacies. Even if a will or trust exists, documents alone often fail to capture the full picture. Families discover that crucial assets aren’t documented, property titles don’t match up, and unfinished business turns “simple” estates into legal quagmires. Source: Ledbetter Law.

- Average Probate Timeline: 6 months to 2 years is typical; backlogs and disputes can drag it out even longer. Source: Trust & Will 2024 Probate Study.

- Costs: 3%–7% of the estate value vanishes in fees—attorneys, executors, court costs. Many folks wrongly think it'll be a quick, cheap wrap-up.

- Knowledge Gaps: Over half of people have zero clue how probate works, yet nearly two-thirds end up needing pros to bail them out.

It's like being thrown into a game of Monopoly, but the board is on fire, and everyone's yelling rules you never learned. Irreverent truth: Without planning, your family's legacy becomes a probate piñata.

Information Overload—With Key Details MIA

Settling an estate means answering gut-wrenching questions in real time:

- Where the hell are all the accounts, debts, properties?

- Who gets what? Who pays what?

- What do these legal docs actually mean, especially when they're incomplete or outdated?

Survivors must hunt down everything from bank statements and insurance policies to property deeds and those pesky digital passwords. Many estates lack even a basic inventory. Critical mail slips through cracks, leading to missed payments and financial disasters. If docs exist, they're scattered like confetti or buried in legalese without signatures.

Real-Life Horror Story: A daughter discovers too late that her dad's house is behind on the mortgage. But she can't act because she's not yet legally appointed. Cue court delays, mounting stress, and the risk of losing the family home. Source: Martins Legal.

This is where StashDog shines. Our app lets you create a centralized digital vault for all your assets—physical, financial, digital. No more scavenger hunts; just organized stashes that your family can access securely when needed. Think of it as your anti-chaos sidekick for life's messiest moments.

Family Feuds, Legal Limbo, and Emotional Gut Punches

It's not just paperwork—it's emotional warfare. Court delays, fuzzy documents, and arguments over “what Mom really wanted” spark family feuds that last years. Surviving spouses and kids often tumble into financial freefall, especially if they relied on the deceased's income.

- State-by-State BS: Probate rules vary wildly by state, so you're decoding a patchwork of laws when you're already wrecked.

- Public Spectacle: Probate turns private family drama into public record—who knew your aunt's debts would be Google-able?

The fallout? Strained relationships, therapy bills, and a legacy tainted by conflict. But hey, at StashDog, we're all about building bridges, not burning them. By organizing your info now, you give your family the tools to honor your wishes without the drama.

Unmasking the Hidden Information Crisis

At its core, estate settlement isn't one task—it's 50+ micro-decisions, each hinging on info that's missing, outdated, or buried. Traditional plans obsess over legal papers but ignore the practical ops. Survivors need a roadmap, not a riddle wrapped in legalese.

Most families don't even know what “counts” as an asset or liability until crisis hits. Enter StashDog: We help you inventory everything—from your vintage comic collection to crypto wallets—with easy sharing options for trusted family members. Proactive stashing means reactive chaos averted.

Your Escape Plan: Proactive Prep and Open Talks

To keep your loved one's legacy from becoming a bureaucratic horror flick:

- Go Beyond Docs: Build a full estate plan. Inventory assets, debts, digital accounts. Update titles, beneficiaries, and ensure POAs actually work IRL.

- Talk It Out: Make sure survivors know where the info lives and how to grab it. No secrets in the stash!

- Get Expert Backup: Complexity demands pros—don't wing it. Tools like StashDog integrate seamlessly with legal advice for a smoother ride.

Estate management isn't about “stuff”—it's about information. The less you organize, the harder it hits those you love. Most families only uncover the gaps when it's too late. Don't be that family. Start stashing smart with StashDog today and turn potential pandemonium into peaceful closure. Sources: Trust & Will, Legal Mama.

Ready to tame the chaos? Download StashDog and build your legacy fortress now.